About StockCentral

To be a successful stock investor, you need tools. We’re past the age of slide rules and speculation –– you need the right tools in order to interpret the data and see the complete picture of the market.

You also need data. Prices, ratios, and averages are the fuel that drives the financial engine. You need to have a consistent, reliable source of data on which to base your judgments and calculations about individual stock selections.

You also need data. Prices, ratios, and averages are the fuel that drives the financial engine. You need to have a consistent, reliable source of data on which to base your judgments and calculations about individual stock selections.

And you need insight. You’re an individual, but you’re not in this alone. Harnessing the power of a like-minded community is essential to help you gauge the validity of your own opinions, as well as to discover new ideas for your stock portfolio.

This is why StockCentral was built, way back in 2006. Its features have grown over the years and now include:

Robust Tools for Dividend Research

- Identify stocks that have recently increased their dividends, or monitor a calendar of upcoming and recent dividend payments.

- Find new dividend stock ideas by screening for dividend growth, yield, or payout ratios, or browse the Roster of Dividend Achievers.

- Drill down through high-yielding industry groups to find and rank companies with optimal yields and/or payout ratios, then review each stock’s historical data and charts.

Real Estate Investment Trust (REIT) Research

- Fundamental company reports on all REITs using Funds From Operations (FFO).

- Industry averages for each REIT category.

- REIT screener to find investment candidates.

Stock Screening & Ratio Analysis

- Screen our stock screening database of over 8,000 stocks using parameters preferred by fundamental investors, including the time-tested Take Stock Quality Rating.

- Drill down through sectors, industries, and companies to review key averages for any company, such as profit margins, debt ratios, and return on equity.

- Identify and quantify a company's strengths and weaknesses using common financial ratios, and understand any risks you may be taking by investing in it.

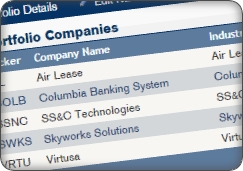

Portfolio Recordkeeping

- Track the total value of your holdings with detailed portfolio transaction recordkeeping.

- Create multiple portfolios and watch lists, and display holdings in dozens of report formats.

- Quality, Mood, and Buy indicators as calculated by Take Stock are displayed for each stock.

Roster of Quality Companies

- Weekly update of companies that meet minimum standards of quality.

- Ratings focus on consistent growth and strong, steady profit margins.

- Great starting point for finding potential investment candidates.

Instant Stock Analysis with Take Stock™

- Take Stock will teach you how to invest in the stock market quickly and easily with a time-tested approach focusing on high-quality companies

- Take Stock provides you with buy, sell or hold indicators for any publicly-traded stock in just seconds! You can drill down to see how the judgments are created.

- If you are new to Take Stock, full "Help" and detailed "Concepts" are provided to get you up to speed quickly with our approach.

Technical Price Charts

- Customizable historical stock price charts offer a variety of technical indicators.

- Chart styles include line, Open-High-Low-Close, and candlestick charts.

- Users may select from several overlays, such as simple moving averages, exponential moving averages, Bollinger bands, RSI, and MACD.

Sector & Industry Averages

- Key averages calculated weekly for all sectors and industry groups.

- Sort to find top performers in any industry.

- Drill down to see company fundamentals of constituent companies.

Subscribe Today!

All of these features are available at a very-affordable annual subscription price. Save even more with ICLUBcentral's Ultra Bundle program or with a multi-year subcription to lock in your rates.